BlackRock is going big on Ethereum. The world’s largest asset manager has snapped up over $500 million worth of ETH in just ten days, according to Arkham. The buying spree comes through its iShares Ethereum Trust, ETHA.

On June 4 alone, the fund added $73.2 million in ETH. The next day, it added another $34.7 million. This brings its total holdings to over $4.85 billion worth of ETH.

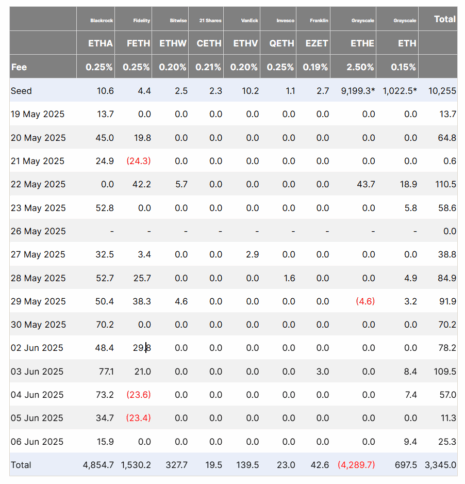

Other firms are also jumping in. On June 2, Fidelity bought $29.8 million worth of ETH through its FETH Ethereum ETFs. These purchases are helping drive Ethereum ETF inflows across the board. U.S.-based spot Ethereum ETFs have now collected over $3.34 billion in net inflows in the past three weeks, according to data from Farside Investor.

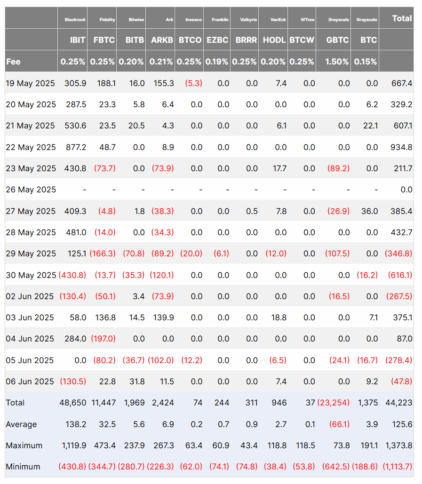

At the same time, spot Bitcoin ETFs are seeing money flow out. In the same 10-day stretch, Bitcoin ETFs recorded $278.4 million in outflows on June 5 alone, led by ARk investment and major withdrawals from Fidelity, Bitwise, and Grayscale. Over the two weeks, total net inflows into Bitcoin ETFs added up to $44.2 billion, but recent days show a clear slowdown, with multiple firms logging consistent red days.

BlackRock CEO Larry Fink shared his thoughts on Ethereum’s potential in a statement. He believes the role of Ethereum and blockchain technology can grow dramatically if there is more acceptability, transparency, and better analytics related to these assets.

According to Fink, growth is not mainly about more or less regulation but depends on liquidity, transparency, and improved data. “I think its a function of liquidity, transparency, and then to that process no different than years ago.”

He compared this process to the early days of the mortgage and high-yield markets, which started slowly but expanded as better analytics and market acceptance developed. “I truly believe we will see a broadening of the market of these digital assets,” Fink said

What’s Ahead for Ethereum?

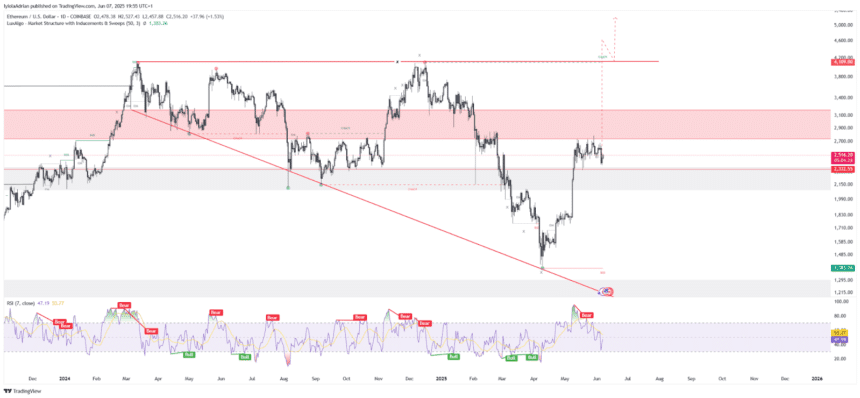

Ethereum’s price jumped from $1,790 to above $2,700 over the past month. This is a 54% increase. it’s showing signs of a breakout.

Currently, the token is forming a pattern called a “Right-Angled Descending Broadening Wedge,” which in past cases has led to big price moves.

As of June 7, Ethereum is trading for $2,516, according to CoinMarketCap. It dipped briefly during a recent market drama involving Elon Musk and Donald Trump but quickly recovered.

Also Read: ETH Season Heats-up: Weekly ETF Inflows in Ethereum Outshines Bitcoin