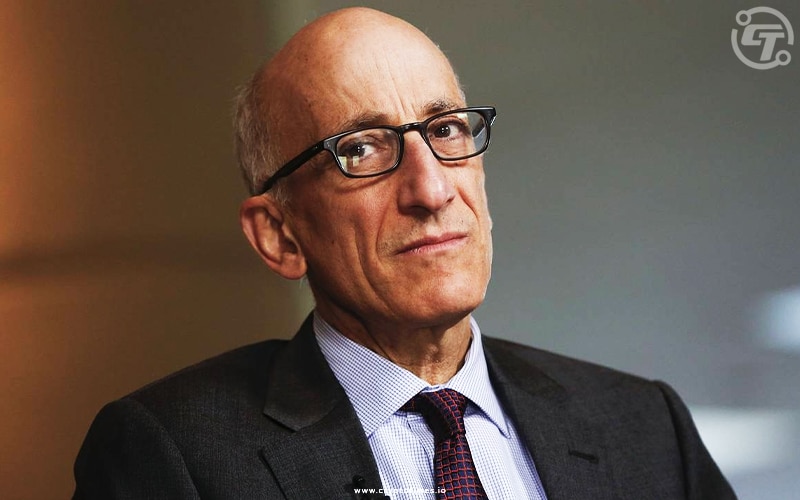

In a recent interview with CNBC’s Jim Cramer, Timothy Massad, the former chair of the Commodity Futures Trading Commission (CFTC), stressed the importance of not overlooking stablecoins and the need for immediate regulatory measures to address potential risks associated with these cryptocurrencies.

As the name implies, stablecoins are a specific type of cryptocurrency designed to be backed by tangible assets, such as the US dollar, with one stablecoin equivalent to one dollar. Massad highlighted the potential of stablecoins as a bridge between the crypto world and traditional finance.

However, Massad expressed concern that regulators tend to keep stablecoins outside the regulatory perimeter, hoping they would disappear on their own.

He argued that this approach is inadequate and emphasized the significance of addressing the risks associated with stablecoins, which he believes could be useful if handled responsibly.

Massad, along with Jay Clayton, the former head of the Securities and Exchange Commission (SEC), previously advocated for immediate crypto regulations to protect investors without having to endure lengthy litigation or wait for laws to be rewritten.

One potential advantage of stablecoins, according to Massad, lies in their ability to enhance payment mechanisms in the United States, a system that currently lags behind other countries in terms of speed and cost.

“I’m sympathetic to a lot of people in government saying … we’re not convinced of the use case here, we don’t see what the value is in the real world,” Massad stated. “But, you know, sometimes it takes time to discover that.”

Also Read: GAO Urges Crypto Reg for Lack of Interagency Coordination

Stablecoins have been gaining attention in the financial world, and Massad’s insights emphasize the need for thoughtful and proactive regulation to harness their potential benefits while mitigating potential risks.