The hype for Bitcoin’s Spot ETF has put the cryptocurrency industry in a thrilling phase, which might decide the fate of Bitcoin over the next few years.

A recent research report by CryptoQuant shares that the launch of Bitcoin Spot ETFs could potentially inject $1 trillion of liquidity into the cryptocurrency market.

The report said that the only way for traditional financial institutions to invest in Bitcoin efficiently is to have access to spot ETFs. This way, the institutions can get exposure to Bitcoin without getting into a hefty legal framework regarding the cryptocurrency investments.

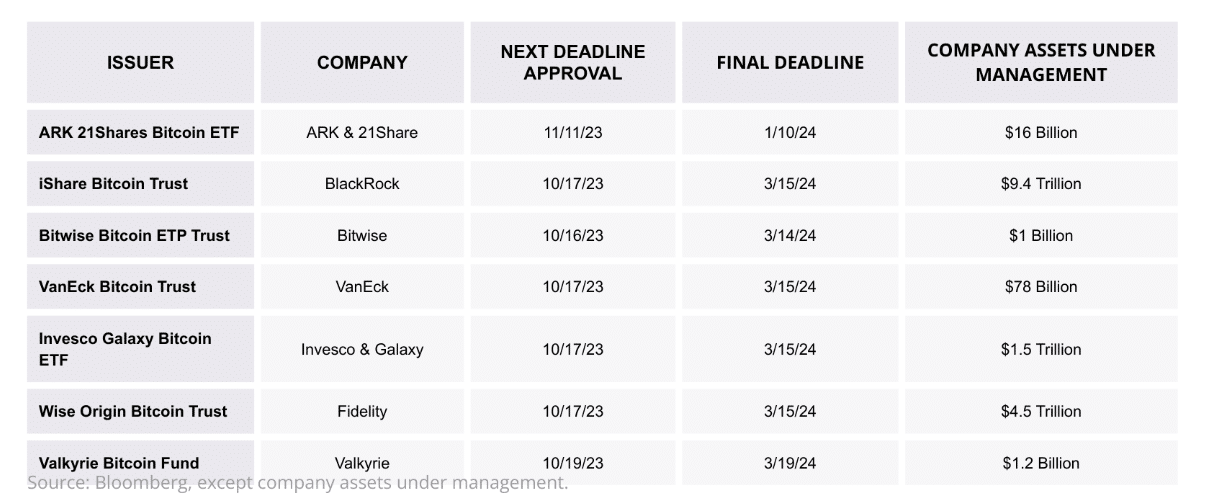

According to the report, seven major companies are waiting for their Bitcoin Spot ETFs, which all have final approval deadlines in 2024. It all has a combined AUM of more than $15 trillion.

For approval from the SEC, companies are also trying to have conversations with the SEC and make amends to their filings for regulatory compliance. For example, recently, Fidelity amended its Bitcoin ETF filing to receive the right disclosures in their application.

It is expected that once ETFs are approved, a sum of $150 billion will inflow into the Bitcoin market. CryptoQunat predicts that the inflow of this capital will increase Botcoin’s market cap by $450 billion to as high as $900 billion.

CryptoQuant’s analysis reveals that the new capital inflow will be potentially bigger than the amount the GBTC fund brought in during the last bull cycle from June 2020 to February 2021.

It has also been predicted that this momentum will increase Bitcoin’s price to as high as $73,000 within a short span of time.

Also Read: Cointelegraph Apologises Over Controversy On BTC ETF Approval