Bitcoin’s price has dropped below $70,000, losing 4.34% of its value just 4 days after reaching a recent high of $73,737 earlier in the week, a $175 short from its all-time record, before trading sideways and ultimately declining

As of the time of writing, the cryptocurrency is trading at $69,285 with a 4% drop in market cap of $1.3 trillion but a 17% surge in trading volume, according to CoinMarketCap.

This drop came along with losses in major U.S. stock markets, including the Nasdaq and S&P 500, prompted by Meta and Microsoft as they announced their shift in investment to the AI sector.

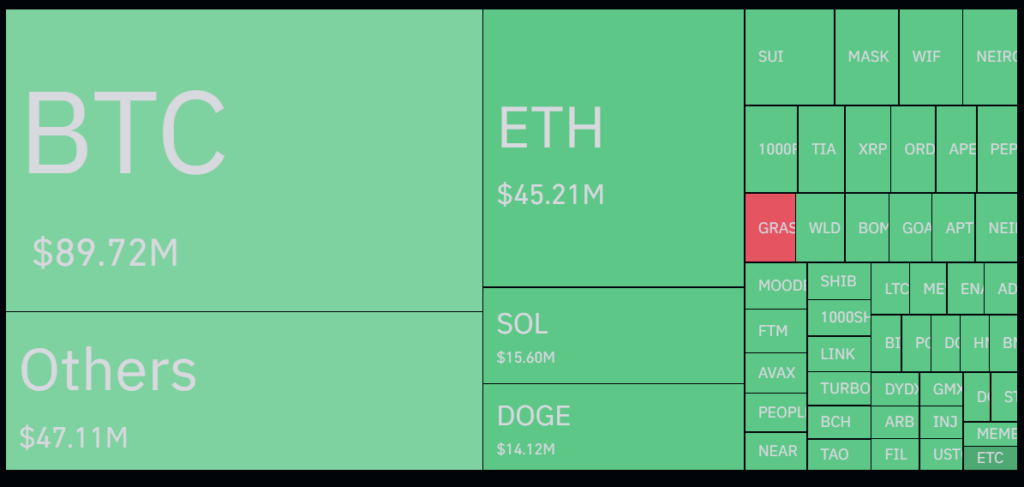

The price decline also led to considerable market liquidations, with $411 million in crypto positions closed, including $89.72 million in Bitcoin alone. Among leveraged positions, liquidations totaled $289.98 million, impacting nearly 96,675 traders across the market

Ethereum also experienced a drop, with a 5.5% fall to around $2,500, while Dogecoin declined 9% to $0.16. This sell-off coincides with broader market losses across altcoins, with Binance Coin, XRP, and Solana down between 3% to 4% each.

Meanwhile, the surge in Bitcoin ETF activity has been noteworthy, with BlackRock’s Bitcoin ETF (IBIT) leading a record $3.3 billion in October trading volume, according to Farside Investors. This “institutional FOMO” drove over $870 million into Bitcoin ETFs on Tuesday, Oct. 29, with IBIT accounting for $640 million.

According to Eric Balchunas, Bloomberg’s ETF strategist, BlackRock’s ETF inflows “shattered records,” while Fidelity’s Bitcoin ETF saw the second-highest inflows at $12.6 million. Analysts project this volume increase could push Bitcoin ETFs to surpass even Satoshi Nakamoto’s Bitcoin holdings within weeks.

In related market action, retail interest has lagged, yet institutional demand has heightened ETF inflows. Miles Deutscher, a crypto analyst, noted that retail activity was pivotal in prior bull cycles and could again drive Bitcoin’s price upward, potentially surpassing the $100,000 mark.

Also Read: Reddit Sells Bitcoin Before Crypto’s Uptober Rally