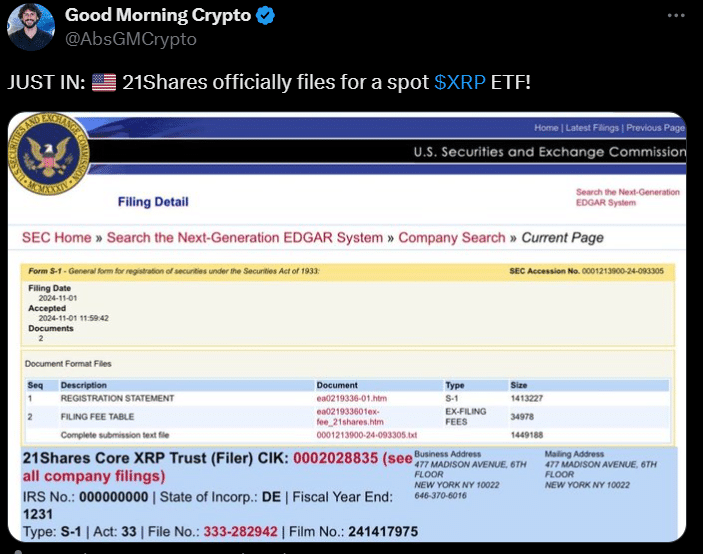

On November 1, investment firm 21Shares submitted a request to the U.S. Securities and Exchange Commission (SEC) to approve a new financial product called a spot XRP exchange-traded fund (ETF).

This fund, named the “21Shares Core XRP Trust,” aims to let people invest in XRP through a regulated market without directly buying the cryptocurrency itself. If approved, the ETF would be traded on the Cboe BZX Exchange, making it easier for everyday investors to gain access to XRP’s market value.

This ETF is designed to track XRP’s market price using a specific price benchmark created by the Chicago Mercantile Exchange (CME), a trusted financial market. Coinbase Custody Trust Company is set to be the custodian for the XRP, which means it would securely hold the XRP for the fund if the SEC approves the ETF.

21Shares is not the only company trying to launch an XRP ETF. Other firms like Bitwise and Canary Capital have also filed similar applications to the SEC. The interest in these kinds of funds started when the SEC approved spot Bitcoin and Ether ETFs earlier this year, leading to a wave of applications for different cryptocurrency ETFs.

However, the SEC hasn’t yet approved any spot XRP ETFs, partly because it is still in a legal battle with Ripple Labs. The SEC argues that XRP is a security (like a stock), but a judge recently ruled that XRP is “not a security” when sold on public exchanges. This decision is currently under appeal by the SEC, which means it could take time before a final decision is made.

The SEC can delay a decision on this application, potentially pushing it into the next presidential administration.

Some crypto supporters hope that if Donald Trump, a Republican candidate, wins the election, he may bring in SEC leaders who are friendlier toward cryptocurrencies, which could improve the chances for XRP ETFs.

Also Read: Ripple Cross-Appeals XRP Case, Tackles Key SEC Issues